The CFO also works with the COO, CSO, chief information security officer, chief risk officer, chief people officer and chief marketing officer on financial-related decisions and implementing financial policies. The job also involves handling functions such as capital budgeting, obtaining debt and equity financing, and managing investor relations. When required, the CFO will also advise on potential mergers and acquisitions targets and initial public offerings. There’s a strong element of regulatory compliance to the job, with the CFO required to make sure that the company’s financial reports are accurate, comprehensive and submitted on time. The CFO usually leads the teams covering accounting and finance, including controllers and VPs of finance, along with middle-ranking and more junior staff such as accountants, book-keepers, tax specialists and data analysts. The term chief financial officer (CFO) refers to a senior executive responsible for managing the financial actions of a company.

What Are Necessary Skills And Qualifications Of A CFO?

“Many such companies have CFOs in the title but are controllers with inflated titles. They’re held directly responsible for the company’s financial stability, which creates a high-pressure work environment–especially during challenging economic times. The need to produce results, manage rigorous business expectations, and mitigate risks can be demanding. However, many CFOs find that the stress of cfo title meaning the job is offset by the financial success and positive reputation their organization can achieve under their leadership. When it comes to financial stewardship, part of the CFO’s job is installing a proper risk management framework to protect against fraud and unauthorized user access. CFOs are constantly looking for ways to close the books faster using automated account reconciliation software.

Chief Marketing Officer (CMO)

- CFOs oversee fundraising strategies, evaluate investment opportunities, and determine how to balance debt and equity.

- According to Salary.com, the average CFO salary in the U.S. is $441,037, with the range typically falling between $334,103 and $565,829.

- The President is often the highest-ranking position at a small business (one without a CEO) or the #2 position at larger enterprises (usually reporting to the CEO).

- Companies look to their CFOs for leadership, support, and guidance regarding highly consequential business decisions.

- The COO makes adjustments to business strategy and helps improve the efficiency of operations.

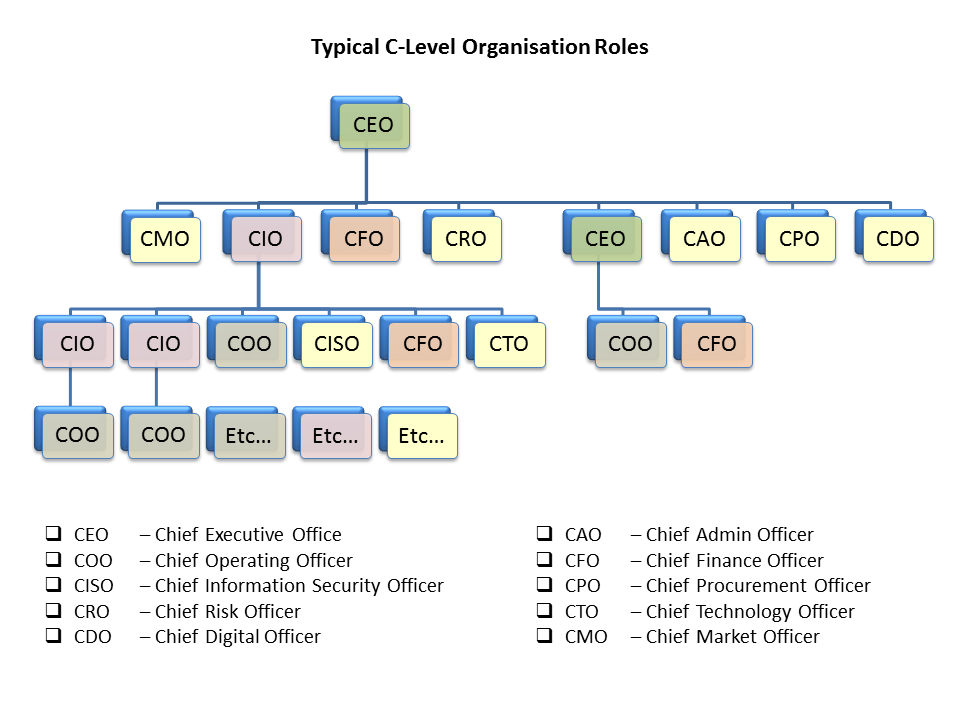

The CFO reports directly to the chief executive officer (CEO) and has substantial input into the company’s investments, capital structure, money management and long-term business strategy. Within the hierarchy of an organization, it’s easy to confuse the roles of a chief executive officer (CEO) and a CFO. While each takes on different responsibilities within a company, the CEO and CFO work as strategic partners and have a shared vision for the company’s continued success. A CEO oversees the entire company’s operations and holds the highest rank in an organization. The CFO, on the other hand, assumes the highest rank within the financial division of an organization, and CFO responsibilities focus on the financial management of the business. CFOs oversee fundraising strategies, evaluate investment opportunities, and determine how to balance debt and equity.

Chief Financial Officer Education and Experience

A chief technology officer (CTO) is the executive in charge of an organization’s technological needs as well as its research and development (R&D). Also known as a chief technical officer, this individual examines an organization’s short- and long-term needs and uses capital to make investments designed to help the organization reach its objectives. An executive director is a job title used more commonly in non profit organizations. The executive director is appointed by the board of directors and is a leader of the organization.

Its mandate is to work collaboratively to improve financial management in the U.S. government and “advise and coordinate the activities of the agencies of its members” in the areas of financial management and accountability. The aspect I find most rewarding is being at the table when decisions are made, and using my knowledge of the operations and financials to influence the path that the company takes to move to the next level of success. An example from my experience at a construction-related company was being able to lead operational changes that enabled our team to break down barriers that led directly to a 25% increase in our productivity.

People at all levels of an organization have plenty of ideas—they just lack the resources to see them to fruition. The challenge is unleashing innovators by giving them the resources they need, including money, people, time, leadership attention, and physical assets. There are some distinct differences among the three most important financial positions in organizations — CFO, finance director and financial controller. One of the most important CFO duties is ensuring compliance with domestic and international financial regulations. CFOs generally also pick up professional certifications along the way, for example as Certified Public Accountant, Chartered Accountant, Chartered Financial Analyst, Certified Financial Planner or Certified Management Accountant. CFOs will, of course, need to work their way up to the position, and most are appointed internally.

For over a decade, McKinsey has conducted a biannual survey to take the global pulse of people in the CFO role. As their jobs expand, CFOs today have opportunities for leadership as never before—working together with C-suite peers, line managers, investors, and boards to focus on performance and capabilities, rather than just numbers. The primary function of a CFO is to understand past financial performance and be able to look ahead and accurately predict the organization’s financial future. Those in this position usually manage finance departments, including a team of controllers and other financial personnel, such as analysts and administrators.

Not only is a CFO responsible for a company’s past and present financial situation, they are also a key player in a company’s future growth potential. A CFO must be able to identify and report what areas of a company are most efficient and how the company can capitalize on this information. The CFO is also responsible for the company’s present financial condition, so they must decide how to invest the company’s money, taking into consideration risk and liquidity. In addition, the CFO oversees the capital structure of the company, determining the best mix of debt, equity, and internal financing. Addressing the issues surrounding capital structure is one of the most important duties of a CFO. If you asked any company’s chief financial officer (CFO) what they do, you would probably be in for a three-hour conversation.